Finance organizations are striving for accurate bookkeeping and optimal cash management but are continually hindered by queues of documents holding the data they need — Invoices, Purchase Orders, order slips / receipts — waiting to be keyed-in to facilitate a proper 3-way match, then mapped to GL codes and spend categories. By automating the extraction of data from the various document types as well as providing further workflow steps like integrations, routing, and categorization —Finance professionals that automate AP with Work.AI get the data they need more efficiently and correctly than their manual processing.

Manual inefficient process: an estimated 36% of firms use paper invoicing and 47% rely on manual processes for approval.

High operational cost: the average cost to process an invoice is $12.90.

Missing data and poor visibility: around 58% of businesses say they need real-time visibility into accounts payable.

Faster AP processing for more eligibility of early payment discounts and avoidance of late fees or other penalties

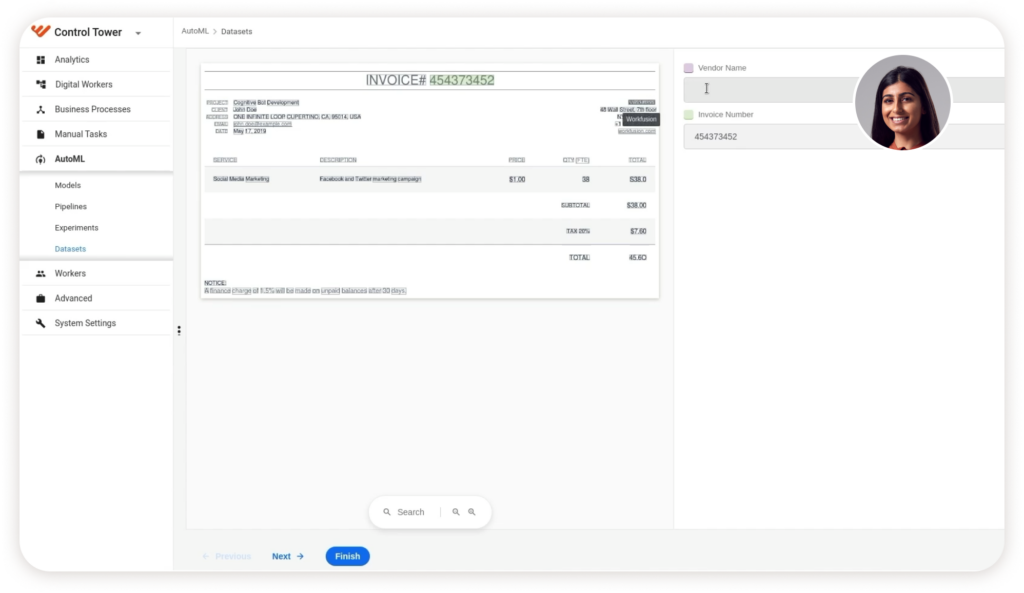

Simplify approvals and payments with automated document extraction, enrichment, and integration of systems

Improve cash flow by submitting payments closest to due dates and early discount windows

Enhance vendor / supplier relationships for increased trust and reliability

Higher quality data with enhanced quality checks and fewer data entry errors increasing confidence of dates, etc.

Value in weeks with No Code, pre-built models, and existing integrations

reduction of manual work of keying-in invoices, POs, etc.

Accuracy of submitted requests

STP improvement

April is an AI Accounts Payable Specialist who tackles invoice variability and helps organizations gain visibility into their supply chain/accounts payable process.